How the Magnificent 7 and AI Impact Your Portfolio

How the Magnificent 7 and AI Impact Your Portfolio

Preferred Resource Group | Sept 15, 2025

There's been a lot of talk in recent years about technology, artificial intelligence, and its impact on portfolios. This has only increased with the rising popularity of the so-called “Magnificent 7” and the growing adoption of AI in our everyday lives.

We'd like to share our perspective on this matter and how it impacts your financial planning. This is a big topic, so we'll cover this from the most important angles, including an update on the “Magnificent 7,” the economic impact of AI, and our approach to maintaining a balanced, long-term investment portfolio.

The key is finding the right balance between participating in technological growth while managing the risks that come with market concentration. We hope this helps deepen your understanding on the way we approach fast-growing industries, without taking unwanted risk.

The Role of Technology Companies in a Portfolio

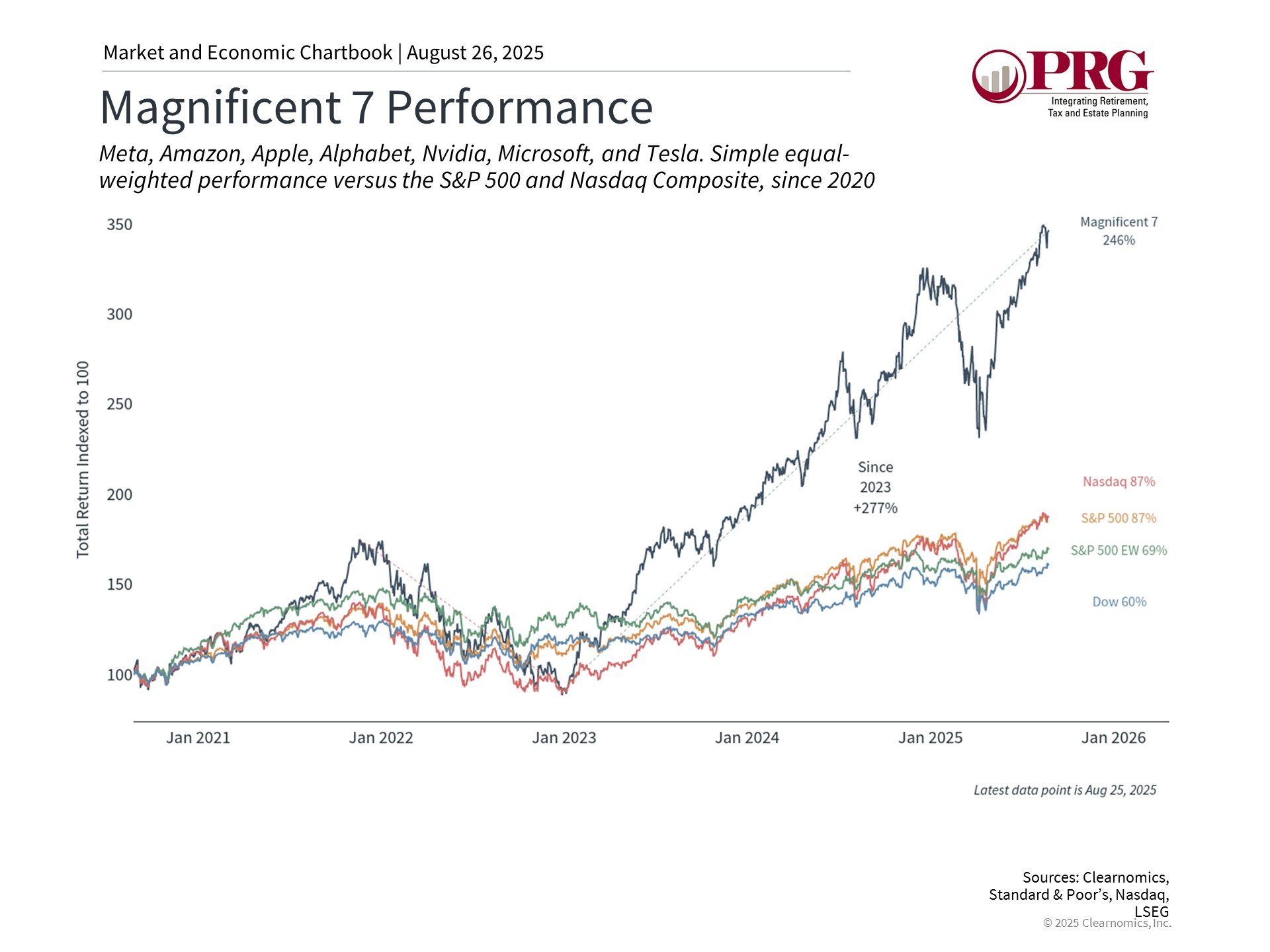

The Magnificent 7 refers to seven large-cap technology-related companies that have driven significant market performance and captured investor attention in recent years: Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia, and Tesla. These stocks have significantly outpaced broader market indices, as the accompanying chart shows. You may have also heard the term “hyperscalers” which refers to companies that are rapidly investing in AI infrastructure.

The technology sector now represents a substantial portion of the U.S. stock market, at about 35% of the S&P 500 index.1 This means that many investors hold more of these companies in their portfolios than they may realize.

The Acceleration of AI in Markets and the Economy

Artificial intelligence has moved beyond the hype stage and is now affecting the broader economy as companies adopt these technologies. The amount invested in AI infrastructure is now in the hundreds of billions, driven by the largest companies.

What makes these numbers meaningful is the transformation occurring across the technology sector. Companies like Microsoft, which recently became the second company to reach a $4 trillion market value alongside NVIDIA, aren't just benefiting from investor enthusiasm – they're creating broad access to AI capabilities.

Several Magnificent 7 companies have delivered strong earnings that exceeded expectations, driving the overall market higher. While these results are encouraging, they also raise important questions about sustainability and current valuation levels that we should carefully monitor. In fact, it was just a few months ago that investors were skeptical about the returns on these AI investments.

Managing Concentration Risk While Capturing Growth

While the performance of technology giants has been impressive, it also highlights what is known as “concentration risk” - a situation where a relatively small number of companies affect portfolio returns.

Concentration risk is the opposite of diversification, and should be taken seriously. On one hand, technology companies have demonstrated exceptional ability to generate growth. On the other hand, having a large portion of market returns dependent on a small group of companies can create volatility. Even the best companies experience challenging periods.

For long-term investors, this environment reinforces the importance of regular portfolio reviews. While it may be tempting to increase exposure to recent winners, a cornerstone of prudent investing is maintaining balance across sectors, company sizes, and geographic regions.

we're here to help you navigate these opportunities and ensure your investment strategy remains aligned with your long-term financial goals. Please don't hesitate to reach out if you'd like to discuss how these developments might affect your specific situation.

Sources:

https://www.spglobal.com/spdji/en/indices/equity/sp-500/#data

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.